We are often asked, “What’s going on in the markets? What deals are hot right now? Where is the money flowing?”

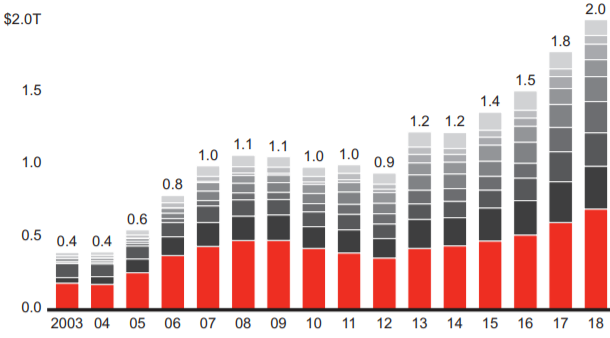

The answer is that there is more money chasing more deals than ever before in human history. Bain reports there is now over $2 trillion seeking deals.

What types of deals? Buyouts continue to be the most popular deal type with sponsor-to-sponsor deals increasing in size and frequency – one private equity firm buying a company from another private equity firm – with North America and Europe dominating the deal flow. Business services, software, distribution, healthcare and insurance are the leading industries in terms of overall investment. Private lenders deserve an honorable mention here – this space has seen tremendous cash inflows in the last two years.

Why is the private equity space so active and flush with cash? The returns justify the allocation of capital, outperforming publicly-traded equities in all major market regions:

These are heady times in the private equity markets.

What does this mean for you as a business owner?

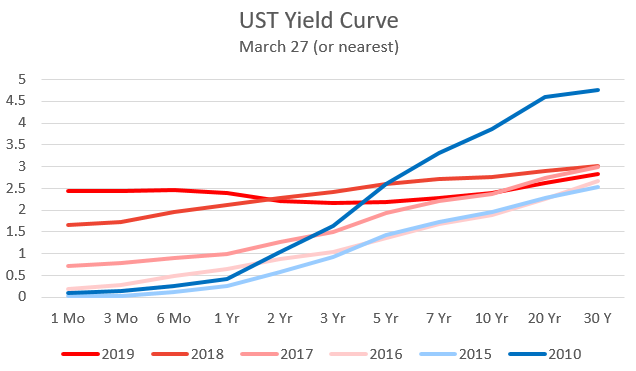

It means that the party rages on, flashing a sell signal to you. The time to sell is when markets are at a peak. Notice the word “a” not “the” because no one knows when the tide will turn, we just know that it markets are cyclical. The yield curve just flashed an ominous sign portending a recession. The top red line shows short-duration US Treasuries yielding more than longer-dated US Treasuries – a perfect predictor of recession every time this has happened since WWII.

VCA Graphic from treasury.gov data

And the time to sell is when markets are at a peak. If you wait too long, squeezing the last bit of juice out of your capital expenditures and other investments, you risk becoming fodder for the type of “distressed” investor that dominated the market during the Great Recession:

Hint: you want to be an “opportunistic” investment target, not a “distressed” target.

The message of the day: Run! Don’t walk. The time to act is now.

Vertical Capital Advisors can help your business plan and execute strategies that enable your enterprise to thrive in all market conditions.

Call me. It is time to plot your strategy to maximize the exit value of your company.